Budgeting is the cornerstone of making personal finance work. But with so many systems, where can you start? The 50/30/20 rule is one of the most recognized and easiest-to-use systems for beginners. It is easy to understand, flexible, and can be used by many learning types.

So, the question is: Can the 50/30/20 budgeting method work for your income type? This guide will outline how to use it, whether you are salaried, self-employed, hourly, or working with gig income.

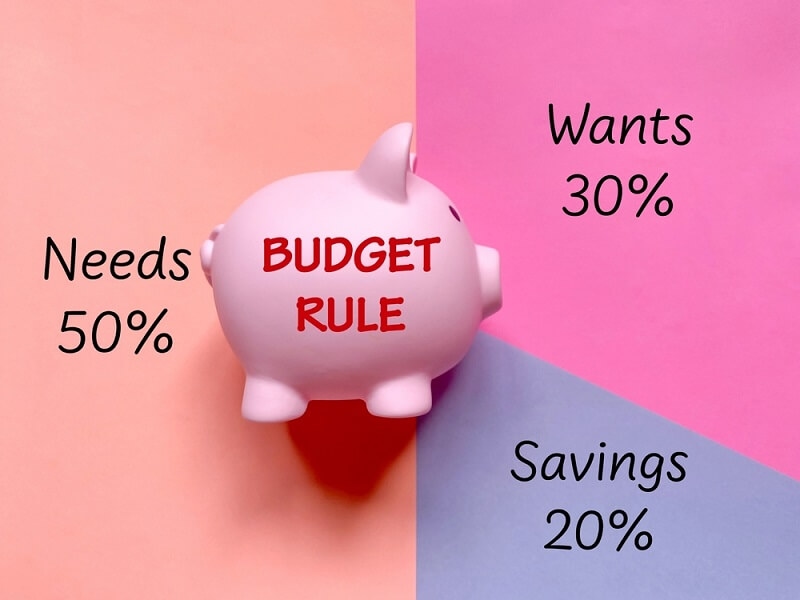

The 50/30/20 rule can be a percentage-based budgeting guide to spend your take-home pay on three main categories:

In their book All Your Worth, Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi, popularized this system. Its beauty is its simplicity, making it an excellent fit for novice spenders or anyone looking to bring balance to their financial life.

These are fixed, unavoidable expenditures that can be classified as lifestyle essentials.

If these expenses exceed 50% of your income, consider whether you can re-evaluate your lifestyle or cut costs.

These expenditures improve your quality of life; they are not 'needs' for living.

This uses discretionary space to enjoy life without being irresponsible.

This portion helps build your future and reduce financial stress.

Includes:

Even if you can’t hit 20% right away, any consistent saving helps build long-term security.

The 50/30/20 budget (also called the "Balanced Budget") method is also reasonably popular because of the following features:

It is in categories rather than line items so that a standard budget will fit most people's needs, including gig workers and those paid hourly.

If your income barely covers your essentials, saving 20% may seem out of reach. But don’t write off this method just yet.

Remember, the key isn’t perfection—it’s progress. The rule is a framework, not a financial commandment.

The 50/30/20 rule can still work even if your income isn’t consistent. The main challenges for budgeting for gig workers in the U.S. are predicting cash flow and handling tax responsibilities.

With some adjustments, the percentage budgeting system keeps gig workers in control of fluctuating finances.

Irregular income isn't just for gig workers—it applies to freelancers, seasonal workers, and commission-paying workers. Using the 50/30/20 rule with this type of income requires a different strategy.

When you budget from unpredictable income, you can still use the 50/30/20 rule to remain relatively structured, even if you skew it a little.

For hourly employees, inconsistent work hours, overtime, and seasonal shifts can impact your paycheck. Still, the 50/30/20 rule can provide much-needed structure.

By aligning your budget with your pay cycle, you make the 50/30/20 method more functional and less frustrating.

The good news is that you can still customize the 50/30/20 rule to better fit your reality without abandoning it altogether.

Every household is different. You don’t have to stick rigidly to the 50/30/20 percentages to benefit from this system.

Use these as stepping stones to eventually get closer to the original breakdown.

Budgeting does not have to be done on the back of an envelope. Embrace modern tools to make tracking and complying with your plan easier.

These tools can help you take the rule from theory to practice. Regarding budgeting, some people are visual learners, and others are hands-on planners.

Yes, though you may need to start with adjusted ratios. You can focus on meeting your needs and saving small amounts regularly.

That’s a common issue in high-cost areas. Consider reducing other expenses, sharing costs, or increasing income if possible.

Combine incomes and expenses, then apply the percentages to your total household net income.

It depends on your style. The 50/30/20 rule is more straightforward and less time-consuming, while zero-based budgeting is more detailed and precise.

The 50/30/20 rule described is a straightforward way to budget! This flexible budgeting strategy is simple enough for anyone to follow, and it fits several earners, whether you earn a salary, are a gig-economy worker, or receive variable income.

Whether you are just getting started or need a budget reset, the 50/30/20 budgeting method can help you learn to spend smarter, save more consistently, and feel better about your finances.

Even if your income doesn’t perfectly match the percentages representing the different categories, the philosophy behind this budget rule for hourly workers, freelancers, and traditional employees is the same. The outcomes will differ if you direct money to serve your goals!

This content was created by AI